According to a report by McKinsey & Company on "Globalization in transition: The future of trade and value chains" (2019), businesses are increasingly expanding internationally, driven by the digital revolution. This expansion requires adapting to local markets, including regulatory compliance and financial management. However, operating in different countries comes with its own set of challenges, especially when it comes to complying with local regulations and managing diverse financial systems.

This is where Odoo, the all-in-one business management software, steps in with its comprehensive localisation packages tailored to meet the specific needs of businesses operating in different regions.

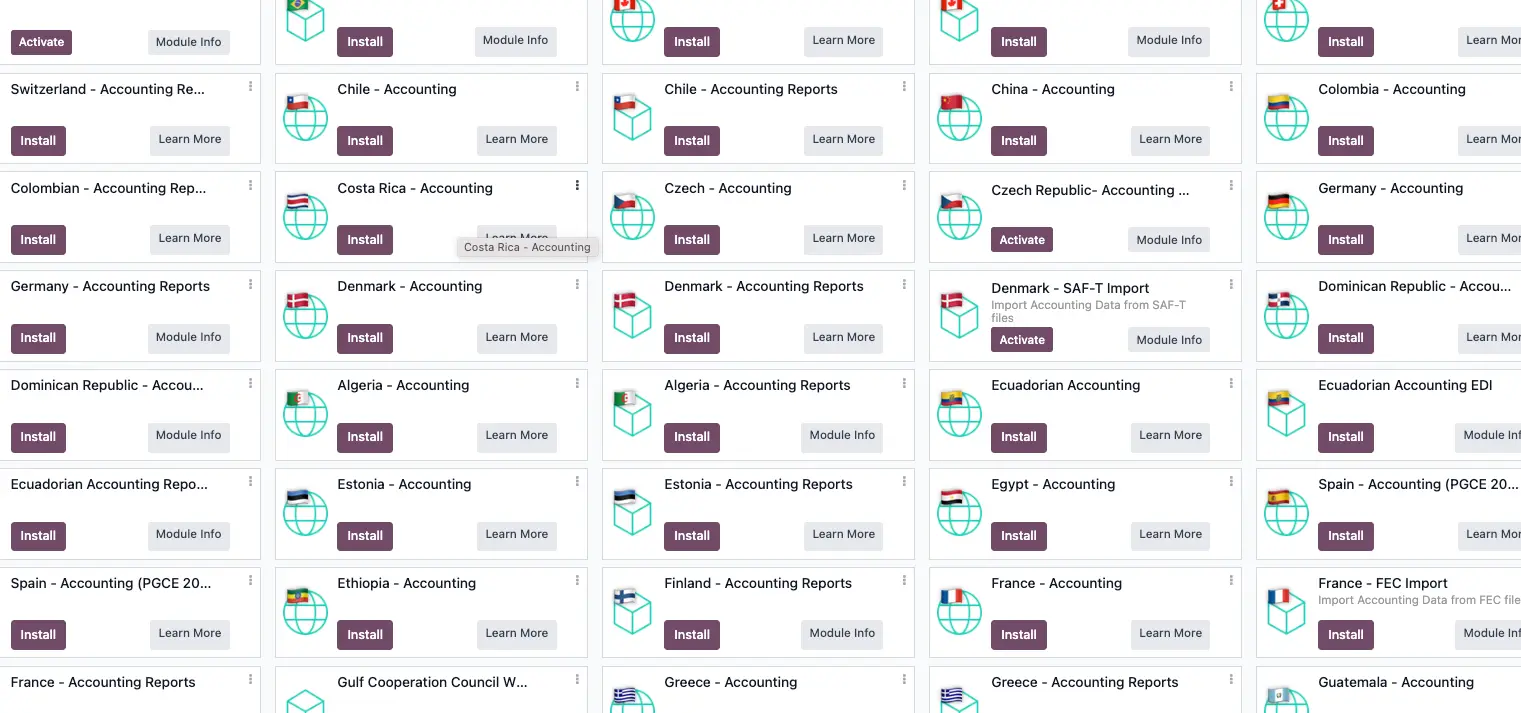

Odoo's incredible number of countries that have their own localisation package and configurations is outstanding - a feat that's particularly impressive considering many other prominent software vendors are still playing catch-up with their localisations (but let's not name names 😉). The impressive range of countries and regions covered is in large part thanks to Odoo's open-source roots and collaborative efforts with developers. This approach has enabled the incorporation of localisations often over-looked by the bigger players, as they have often been initiated by local Odoo partners, showcasing the power of community-driven development.

The Importance of Localisation in Global Expansion

Localisation goes beyond mere translation. It involves adapting your business operations, products, and strategies to meet the local preferences, legal requirements, accounting rules, and business practices of each target market. This process is crucial for several reasons:

Regulatory Compliance: Different countries have varied regulations regarding taxation, employment, privacy, and consumer protection. Non-compliance can result in fines, legal challenges, and reputational damage.

Customer Engagement: Customers are more likely to engage with businesses that resonate with their local culture, language, and preferences. Localisation enhances customer experience and loyalty.

Competitive Advantage: By localising your operations, you can outperform competitors who may not have a strong local presence or understanding of the market.

Understanding Odoo Localisation Packages

Odoo offers a range of localisation packages designed to address the regulatory and fiscal requirements of specific countries or regions.These packages encompass various modules and features that ensure seamless integration with local practices and compliance with legal frameworks. From taxation and accounting to language and reporting standards, Odoo's localisation packages provide businesses with the tools they need to operate efficiently in diverse markets.

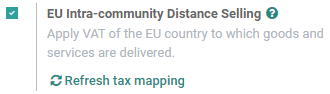

For instance, Odoo's European Union VAT Compliance module automates VAT calculations and reporting in accordance with EU regulations, providing businesses operating in Europe with a streamlined solution for tax compliance. The package includes features such as automated VAT calculation, generation of VAT statements, and compliance with EU tax regulations.

To help you further understand how it works, imagine a scenario where a small e-commerce startup from the United States decides to expand its operations into Europe and Asia. The challenges are manifold: different tax systems, multiple currencies, and a need for customer support in various languages. With Odoo's localisation packages, this daunting task becomes manageable.

The startup can now easily navigate tax regulations, offer products in multiple currencies, and provide customer service in several languages, all while ensuring compliance with local laws. This adaptability not only accelerates market entry but also significantly enhances the customer experience, laying a solid foundation for sustained growth.

List of supported countries as of March 2024

Country | Localisation Features | Link to Odoo Localisation Documentation |

Algeria |

| |

Argentina |

| https://www.odoo.com/documentation/17.0/applications/finance/fiscal_localizations/argentina.html |

Australia |

| https://www.odoo.com/documentation/17.0/applications/finance/fiscal_localizations/australia.html |

Austria |

| https://www.odoo.com/documentation/17.0/applications/finance/fiscal_localizations/austria.html |

Belgium |

| https://www.odoo.com/documentation/17.0/applications/finance/fiscal_localizations/belgium.html |

Bolivia |

| |

Brazil |

| https://www.odoo.com/documentation/17.0/applications/finance/fiscal_localizations/brazil.html |

Canada |

| |

Chile |

| https://www.odoo.com/documentation/17.0/applications/finance/fiscal_localizations/chile.html |

China |

| |

Colombia |

| https://www.odoo.com/documentation/17.0/applications/finance/fiscal_localizations/colombia.html |

Costa Rica |

| |

Croatia |

| |

Czech |

| |

Denmark |

| |

Dominican Republic |

| |

Ecuador |

| https://www.odoo.com/documentation/17.0/applications/finance/fiscal_localizations/ecuador.html |

Egypt |

| https://www.odoo.com/documentation/17.0/applications/finance/fiscal_localizations/egypt.html |

Ethiopia |

| |

Finland |

| |

France |

| https://www.odoo.com/documentation/17.0/applications/finance/fiscal_localizations/france.html |

Germany |

| https://www.odoo.com/documentation/17.0/applications/finance/fiscal_localizations/germany.html |

Greece |

| |

Guatemala |

| |

Honduras |

| |

Hongkong |

| https://www.odoo.com/documentation/17.0/applications/finance/fiscal_localizations/hong_kong.html |

Hungary |

| |

India |

| https://www.odoo.com/documentation/17.0/applications/finance/fiscal_localizations/india.html |

Indonesia |

| https://www.odoo.com/documentation/17.0/applications/finance/fiscal_localizations/indonesia.html |

Ireland |

| |

Israel |

| |

Italy |

| https://www.odoo.com/documentation/17.0/applications/finance/fiscal_localizations/italy.html |

Japan |

| |

Kenya |

| https://www.odoo.com/documentation/17.0/applications/finance/fiscal_localizations/kenya.html |

Lithuania |

| |

Mexico |

| https://www.odoo.com/documentation/17.0/applications/finance/fiscal_localizations/mexico.html |

Mongolia |

| |

Netherlands |

| https://www.odoo.com/documentation/17.0/applications/finance/fiscal_localizations/netherlands.html |

New Zealand |

| |

Norway |

| |

Pakistan |

| |

Panama |

| |

Peru |

| https://www.odoo.com/documentation/17.0/applications/finance/fiscal_localizations/peru.html |

Philippines |

| https://www.odoo.com/documentation/17.0/applications/finance/fiscal_localizations/philippines.html |

Poland |

| |

Portugal |

| |

Romania |

| https://www.odoo.com/documentation/17.0/applications/finance/fiscal_localizations/romania.html |

Saudi Arabia |

| https://www.odoo.com/documentation/17.0/applications/finance/fiscal_localizations/saudi_arabia.html |

Singapore |

| https://www.odoo.com/documentation/17.0/applications/finance/fiscal_localizations/singapore.html |

Slovak |

| |

Slovenia |

| |

South Africa |

| |

Spain |

| https://www.odoo.com/documentation/17.0/applications/finance/fiscal_localizations/spain.html |

Sweden |

| |

Switzerland |

| https://www.odoo.com/documentation/17.0/applications/finance/fiscal_localizations/switzerland.html |

Taiwan |

| |

Thailand |

| https://www.odoo.com/documentation/17.0/applications/finance/fiscal_localizations/thailand.html |

Turkey |

| |

United Arab Emirates |

| |

United Kingdom |

| |

Ukraine |

| |

United States of America |

| |

Uruguay |

| |

Venezuela |

| |

Vietnam |

| https://www.odoo.com/documentation/17.0/applications/finance/fiscal_localizations/vietnam.html |

Zambia |

|

Odoo Pricing

Odoo's pricing strategy is designed to accommodate the diverse economic landscapes of different countries, ensuring businesses worldwide can access its comprehensive suite of tools. The company's website provides a detailed breakdown of pricing per country, reflecting variations in currency and economic conditions.

For instance, in the United States, Odoo's pricing starts at $24 per user per month for all applications. In contrast, for businesses operating in emerging markets such as India, and Africa, Odoo offers an adjusted pricing model to align with the local purchasing power.

This ensures that small to medium-sized enterprises (SMEs) in these regions can also leverage Odoo's powerful features to scale their operations, and are not priced out by high USD/EUR subscription costs.

To check Odoo’s updated pricing for your country visit https://www.odoo.com/pricing-plan

Inclusions of Packages

Odoo's localisation packages are developed to address the unique needs of businesses expanding into new territories. These packages include a suite of applications and modules that cater to various aspects of business operations, including accounting, HR, sales, and customer relationship management (CRM), all tailored to meet the specific requirements of different regions and countries. Here's a closer look at the typical components that make Odoo's localisation packages an indispensable tool for global business operations.

1. Taxation and Accounting Compliance

Automated Tax Calculations

Odoo simplifies the complex world of taxation by automatically configuring local tax rates and applying them to transactions, ensuring accuracy and compliance with minimal effort.

Fiscal Position Mapping

This feature dynamically adjusts tax rates based on the geographical location of the customer or the company, optimising tax handling for cross-border transactions.

Local Chart of Accounts

Odoo provides a pre-configured chart of accounts that aligns with local accounting standards, making it easier for businesses to maintain compliant financial records.

Electronic Invoicing

With support for the generation and submission of invoices in formats mandated by local tax authorities, Odoo streamlines the invoicing process, ensuring compliance and efficiency.

Financial Reports

The platform offers customisable financial reports, such as profit and loss statements, balance sheets, and cash flow statements, tailored to meet local accounting standards.

2. Human Resources and Payroll

Localised Payroll

Calculating salaries, taxes, and social security contributions is made straightforward with Odoo's localised payroll system, ensuring adherence to local laws.

Public Holidays Management

Odoo integrates local public holidays into the HR system, facilitating accurate leave management and planning.

Contract Templates

The platform provides contract templates that comply with local employment laws, simplifying the contract creation process.

3. Sales and Invoicing

Localised Invoice Templates

Odoo's invoice templates are designed to meet the legal requirements of each country, including necessary tax breakdowns and company information.

Multi-Currency Support

The system handles transactions in both local and foreign currencies, with automatic currency conversion based on daily rates, enhancing global transaction capabilities.

4. Inventory and Logistics

Units of Measure

Odoo supports local units of measure for products and services, ensuring accuracy and compliance in inventory management.

Shipping Integrations

The platform integrates with local shipping providers, enabling accurate and efficient logistics management.

5. Legal and Regulatory Reporting

Tax Reporting

Odoo facilitates the generation of tax reports required by local authorities, such as VAT/GST/BAS returns, ensuring businesses stay compliant with minimal hassle.

Legal Statements

The system supports the creation of legal statements and reports specific to local regulations, aiding in regulatory compliance.

6. Language and Localisation

Multilingual Support

Odoo offers its user interface, documentation, and customer-facing documents in local languages, enhancing usability and customer engagement.

Local Date and Number Formats

The platform supports local formats for dates, numbers, and currencies, ensuring clarity and compliance in financial transactions.

7. Payment and Banking Integration

Local Payment Gateways

Odoo integrates with local payment gateways and financial institutions, facilitating smooth payment processing.

Bank Statement Imports

The system supports importing bank statements in formats used by local banks, streamlining financial reconciliation processes.

8. E-commerce and Website

Localised Checkout Process

Odoo customises the e-commerce checkout process to include local payment methods, shipping options and region specific integrations, and tax calculations, optimising the customer experience.

SEO Tools

The platform provides tools to optimise websites for local search engines, enhancing online visibility and market reach.

9. Customer Relationship Management (CRM)

Local Market Adaptations

Odoo customises sales and marketing tools to align with local market practices and consumer behaviour, ensuring effective customer engagement.

10. Product and Service Localisation

Local Product Catalogues

The platform adapts product catalogues to reflect local market preferences, including translations and local currency pricing, catering to diverse customer needs.

11. Data Protection and Privacy

Compliance Tools

Odoo offers tools to help businesses comply with local data protection and privacy laws, such as the GDPR in Europe, safeguarding customer data and ensuring regulatory compliance.

It's important to note that the availability and depth of localisation features in Odoo can vary significantly between different countries. This variation largely depends on the contributions from the local Odoo community and the presence of official partners in the region. Odoo is actively working on expanding its coverage to include other countries, aiming to enhance the localisation features and support available to users worldwide.

Making the Most of Odoo

Implementing a new business management system, especially one as comprehensive as Odoo, requires careful planning and execution. Here are some considerations to ensure a smooth transition:

Customisation and Integration: While Odoo's localisation packages provide a robust foundation, businesses may require additional customisation to fully meet their specific needs. Odoo's modular architecture and open-source nature make it highly customisable, allowing businesses to tailor the software to their exact requirements.

Training and Change Management: The success of any new software implementation heavily depends on user adoption. Providing comprehensive training and support to your team is crucial. Odoo offers a wealth of documentation, tutorials, and community forums. Additionally, businesses can seek assistance from Odoo partners who specialise in training and support services.

Scalability: As your business grows, your operational needs will evolve. Odoo's scalability ensures that it can accommodate increasing complexity and volume of transactions without compromising performance. This makes it an ideal solution for businesses looking at long-term global expansion.

In the era of global business expansion, the significance of localisation cannot be overstated. Odoo's comprehensive localisation packages emerge as a pivotal solution for businesses aiming to navigate the complexities of international markets. By offering a suite of tools tailored to meet the regulatory, fiscal, and cultural demands of diverse regions, Odoo empowers businesses to seamlessly adapt their operations, ensuring compliance, enhancing customer engagement, and securing a competitive edge.

Whether you're a small startup or a growing enterprise, leveraging Odoo's localisation capabilities can transform the daunting challenge of global expansion into a strategic advantage, fostering sustainable growth and success across borders.

Odoo for everyone, everywhere